March 11, 2015

Japan Fair Trade Commission

I. Purpose and Methods of the Survey

1. Purpose of the Survey

In line with the Regulations on Abuse of a Superior Bargaining Position under the Antimonopoly Act, the JFTC is confronting practices that involve imposing unjust disadvantages on enterprises in a strict and effective manner, while making efforts to prevent violations of the regulations.

The JFTC has been promoting its efforts regarding transactions between shippers and logistics companies more actively since April 2004, by enforcing the Designation of Specific Unfair Trade Practices when Specified Shippers Entrust the Transport and Custody of Goods (Logistics Special Designations), which the JFTC made as one of the Regulations on Abuse of a Superior Bargaining Position under the Antimonopoly Act.

It has been reported that logistics companies have been facing a harsh trading environment in recent years, where, for example, they have been forced by shippers to leave freight charges unchanged despite the trend towards increasing fuel prices*1. In these circumstances, the JFTC decided to conduct a survey of transactions between shippers and logistics companies (hereinafter, the “Survey”) to determine whether or not there have been practices on the part of shippers that could be in conflict with the Regulations on Abuse of a Superior Bargaining Position*2.

2. Survey Methods

(1) Written Survey

The Survey covered ongoing transactions*3 for the transport and custody of articles (hereinafter, “Transport, etc.”) between shippers and logistics companies.

In the written survey, questionnaires were dispatched to 10,000 shippers who were presumed to be entrusting the Transport, etc. of goods and 25,000 logistics companies who were presumed to be receiving entrustment of the Transport, etc. of goods from shippers. The number of questionnaires sent out and the number of respondents are shown below:

|

Enterprises

|

Number of questionnaires sent out (A)

|

Number of respondents (B)(B/A)

|

|

Shippers

|

10,000

|

6,139 (61.4%)

|

|

Logistics companies

|

25,000

|

7,008 (28.0%)

|

Among the respondents to the written survey, 4,530 shippers and 4,620 logistics companies replied that they were involved in transactions for the Transport, etc. of goods. The results of the Survey were compiled based on the responses from these shippers and logistics companies regarding their transactions for the Transport, etc. of goods with counterparties with the highest annual transaction volumes (i.e. the top three counterparties; hereinafter, the “Major Logistics Companies” and “Major Shippers,” respectively).

(2) Hearing

Out of the logistics companies who responded to the written survey, hearings were conducted with 25 respondents regarding the practices done by Major Shippers on them.

3. Survey Period, etc.

(1) Questionnaire dispatch date: July 31, 2014

(2) Reply deadline: September 5, 2014

(3) Survey period: August 1, 2013 to July 31, 2014

II. Evaluation of Survey Results and Measures Taken by the JFTC

1. Overview of Shippers and Logistics Companies

Approximately half of the shippers that responded to the questionnaire were relatively large enterprises, capitalized at over 300 million yen (54.3%) and annual sales of over 10 billion yen (45.8%). In contrast, most of the logistics companies that responded to the questionnaire were relatively small enterprises, capitalized at 50 million yen or less (88.7%) and annual sales of 1 billion yen or less (75.6%).

2. Transactions between Shippers and Logistics Companies

(1) Delivery of Written Documents and Payment Method

Many shippers replied to the question regarding the delivery of written documents for transactions between shippers and logistics companies that they issue written documents when they conduct transactions for the Transport, etc. of goods with their Major Logistics Companies (81.1%), but there were a certain proportion of shippers that do not issue such documents (18.9%).

Regarding the method of payment, approximately 20% of shippers replied that they pay their Major Logistics Companies with drafts, and a certain proportion pay with drafts with a maturity of over 120 day.

(2) Delays in Payment, etc.

a. By type of practice

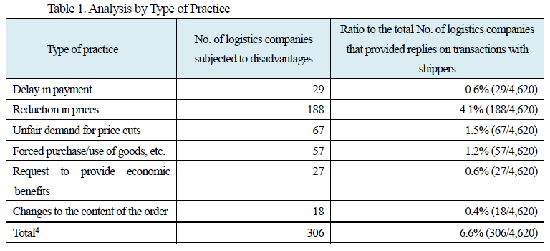

Of the 4,620 logistics companies that replied that they are involved in transactions for the Transport, etc. of goods with shippers, 306 logistics companies (representing 6.6% of the total) replied that they were subjected to at least one disadvantage, this being a delay in payment on the part of the Major Shippers that was not the result of any fault attributable to the logistics companies (see Table 1).

Looking at the survey results by type of practice, 188 logistics companies were subjected to a reduction in prices without any fault attributable to them, representing a higher ratio to the total (4.1% of) than other types of practice (see Table 1).

|

Type of practice

|

No. of logistics companies subjected to disadvantages

|

Ratio to the total No. of logistics companies that provided replies on transactions with shippers

|

|

Delay in payment

|

29

|

0.6% (29/4,620)

|

Reduction in prices |

188

|

4.1% (188/4,620)

|

Unfair demand for price cuts |

67

|

1.5% (67/4,620)

|

Forced purchase/use of goods, etc. |

57

|

1.2% (57/4,620)

|

Request to provide economic benefits |

27

|

0.6% (27/4,620)

|

Changes to the content of the order |

18

|

0.4% (18/4,620)

|

Total*4 |

306

|

6.6% (306/4,620)

|

b. Reasons why logistics companies complied with suggested disadvantages

The JFTC asked the 306 logistics companies that replied that they were subjected to more than one disadvantage, such as delays in payment imposed by their Major Shippers, for the reason why they complied with the disadvantages imposed by the shippers in 386 such cases. The reason given in 171 cases (44.3%) was “concern over the possible effect that a refusal could have on future transaction volumes, transaction amounts, etc.,” and the reason given in 84 cases (21.8%) was “suggestion by the shipper that a refusal could have an effect on future transaction volumes, transaction amounts, etc.”

Thus, a significant number of logistics companies were forced to comply with the suggested disadvantages out of concern over the possible effect on future transactions with their Major Shippers. This conduct by the shippers could be seen as being in conflict with the Regulations on Abuse of a Superior Bargaining Position.

c. Correlation with annual sales of logistics companies

Of the 306 logistics companies described in Item a. above, 282 logistics companies provided information on their annual sales. Out of the 4,620 logistics companies that provided information on their transactions with their Major Shippers, Table 2 shows the ratios of these 282 logistics companies to the 4,372 logistics companies that provided information on their annual sales, categorized by annual sales. As shown in this table, the ratio is highest for annual sales of up to 100 million yen. The table also shows a trend for the logistics companies who replied that they were subjected to disadvantages such as delays in payment, showing that the smaller their sales, the higher the ratio.

(3) Price increase in response to increased fuel prices

Since fuel prices were on the rise during the survey period (August 1, 2013 to July 31, 2014), logistics companies were asked whether they had requested their Major Shippers to accept a price increase to match the increase in fuel prices. Approximately half of the 3,050 logistics companies who answered the question replied in the affirmative (50.4%). Of these logistics companies, approximately 70% replied that their Major Shippers agreed to their request for a price increase, while a certain proportion of them (27.0%) replied that their requests were refused. In other words, although fuel prices were on the rise during the survey period, approximately 60% of these 3,050 logistics companies—consisting of those who had never requested their Major Shippers to accept a price increase and those whose Major Shippers refused their request for a price increase—faced difficulties in getting a price increase despite increasing fuel prices. In addition, approximately 10% of the logistics companies who had requested a price increase replied that their Major Shippers unilaterally left the price unchanged or refused to negotiate. These practices by shippers could be seen as being in conflict with the Regulations on Abuse of a Superior Bargaining Position.

3. Measures Taken by the JFTC

The results of the Survey revealed that in some transactions for the Transport, etc. of goods, shippers acted in a way that could be seen as being in conflict with the Regulations on Abuse of a Superior Bargaining Position. The JFTC should thus closely monitor the situation to prevent shippers from imposing unjust disadvantages on logistics companies. These practices are considered to have been partly due to the fact that trade terms, etc. between shippers and logistics companies have not been agreed on in advance, or because shippers failed to deliver written documents stating the trade terms, etc. to their logistics companies. It is strongly recommended that trade terms, etc. should be clarified and written documents expressly stating the terms should be issued in transactions for Transport, etc. of goods.

The Survey also revealed that in negotiations for a price increase due to an increase in fuel prices, shippers acted in a way that could be seen as being in conflict with the Regulations on Abuse of a Superior Bargaining Position. Some logistics companies replied that even requesting a price increase because of increased fuel prices is difficult, implying that they are in a harsh trading environment. For example, some logistics companies stated that they did not dare request a price increase out of concern over the possibility that the volume of orders would be reduced, and others stated that they refrained from requesting a price increase because shippers would obviously not agree to accept shifting the cost resulting from an increase in fuel prices. Therefore, the JFTC needs to make it widely known to shippers that practice such as unilaterally leaving prices unchanged after receiving a request for a price increase by their logistics companies as well as suggesting to their logistics companies that a request for a price increase could have an effect on future transactions could be seen as being in conflict with the Regulations on Abuse of a Superior Bargaining Position.

In addition, shippers should keep in mind that these practices, if committed during transactions with logistics companies, could not only be seen as being in conflict with the Regulations on Abuse of a Superior Bargaining Position, but also be in conflict with the Act against Delay in Payment of Subcontract Proceeds, Etc. to Subcontractors (hereinafter, the “Subcontract Act”).

Based on the foregoing and to prevent violations, the JFTC has decided to publicize the results of the Survey and implement the following measures:

(1) a. Hold a workshop for shippers and logistics companies to explain the results of the Survey and the details of the Regulations on Abuse of a Superior Bargaining Position and the Subcontract Act.

b. Present the results of the Survey to the trade associations related to shippers and logistics companies, and request these associations to renew their efforts to make the details of the Regulations on Abuse of a Superior Bargaining Position and the Subcontract Act known amongst their members and take other voluntary measures to promote fair transaction practices in the industry, thereby allowing shippers and logistics companies to take voluntary measures to eliminate problems in transactions involving the entrustment of the Transport, etc. of goods.

(2) The JFTC will continue to closely monitor transactions for the Transport, etc. of goods to identify practices that could be in conflict with the Regulations on Abuse of a Superior Bargaining Position or the Subcontract Act, and deal sternly with violations of these laws.

*1 During the survey period (August 1, 2013 to July 31, 2014), the cash shop price (incl. consumption tax) of light oil increased from 137.9 yen per liter (on August 5, 2013) to 147.4 yen per liter (on July 28, 2014). The price started to fall in August 2014, and decreased to 117.9 yen per liter on February 23, 2015. (Source: Agency for Natural Resources and Energy “Gas Station Retail Price Survey”)

*2 In March 2006, the JFTC published the Report on the Survey on the Actual Situation Concerning Transactions between Shippers and Logistics Companies.

*3 Spot transactions were excluded from the scope of the Survey.

*4 While the number of logistics companies by type of action totals 386, because some logistics companies were subjected to disadvantages of more than one type, 306 logistics companies were subjected to at least one type of disadvantage.

*Every announcement is tentative translation. Please refer to the original text written in Japanese.