Summary of Annual Report of the Japan Fair Trade Commission

(April 2023-March 2024)

To enhance business vitality, increase consumer welfare, and stimulate innovation through fair and free competition, the Japan Fair Trade Commission (JFTC) actively implemented competition policy in FY2023. This was achieved through two complementary strategies: "enforcement" and "advocacy." Enforcement involves eliminating violations and restoring competition through the strict and appropriate enforcement of laws and regulations under jurisdiction of the JFTC. Advocacy focuses on improving business practices and proposing revisions to regulations and systems to develop a competitive environment. The JFTC's efforts in FY2023 were centered on the following measures:

1 Developments in Antimonopoly Act (AMA) and Relevant Regulations

1.1 Establishment of the Act on Improvement of Transactions between Freelancers and Enterprises

Considering the diversification of work styles in Japan, and for creating an environment where individuals can stably engage in business entrusted to them, a Bill on the Act on the Improvement of Transactions between Freelancers and Enterprises was submitted to the 211th Diet session on February 24, 2023, with the content that such measures would be taken as requiring enterprises who entrust freelancers with business to clearly indicate the contents of proceeds and other matters. The bill was passed by the House of Representatives on April 6 and the House of Councillors on April 28, enacted, and promulgated on May 12 of the same year (Act No. 25 of 2023).

The Act on Improvement of Transactions between Freelancers and Enterprises is scheduled to go into effect on the date specified by a Cabinet Order within a period not exceeding one year and six months from the date of promulgation. The JFTC has held Study Group on Improvement of Transactions between Freelancers and Enterprises and is currently working on the enactment of the Cabinet Order and the JFTC Rules, in accordance with the Act.

1.2 Revision of Other Laws and Regulations under its Jurisdiction

For strengthening the structure in accordance with the enforcement of the Act on Improvement of Transactions between Freelancers and Enterprises, the JFTC amended the Organization Order of the General Secretariat (Cabinet Order No. 373 of 1952) to increase the number of deputy secretary generals in the General Secretariat by one additional position, among other changes (Cabinet Order No. 84 of 2024, promulgated on March 29 and enforced on April 1 in 2024). In addition, the JFTC amended the Organization Ordinance of the General Secretariat (Prime Minister’s Office Ordinance No.10 of 1978) to newly establish the Office of Ensuring Fair Transactions Involving Freelance Contractors in the Trade Practices Department of the Economic Affairs Bureau (Cabinet Office Ordinance No. 39 of 2024, promulgated on March 29 and enacted on April 1 in 2024).

1.3 Examination of Legislation on Promotion of Competition for Specified Smartphone Software

Under the Headquarters for Digital Market Competition established in the Cabinet, the Digital Market Competition Council is to carry out studies and deliberations on important matters relating to the digital market. The council is chaired by the Chief Cabinet Secretary, and its members include the Minister of State in charge of affairs relating to the JFTC and the JFTC’s Chair.

At the 7th Digital Market Competition Council held on June 16, 2023, the final report on the Competition Assessment of the Mobile Ecosystem was compiled. On the same day, the Cabinet approved the "Grand Design and Action Plan for a New Form of Capitalism 2023 Revised Version," which read that "based on the […] final report on the competition assessment, we will consider a legal framework necessary to ensure a fair and equitable competition environment in the digital market, while assessing the situation in other countries such as Europe and United States." The JFTC, in cooperation with the Cabinet Secretariat, worked for the legislation on Promotion of Competition for Specified Smartphone Software, taking into account the situations in other countries.

2 Strict and Accurate Law Enforcement

2.1 Active Elimination of the AMA Violations

2.1.1 Under the fundamental policy of conducting prompt and effective case investigations, the JFTC takes strict and active measures against diverse cases that accurately respond to social needs. These include price-fixing cartels and bid-rigging cases that have significant impacts on the public, abuse of superior bargaining positions that unjustly disadvantage Small and Medium-sized Enterprises (SMEs), and unjust low-price sales (predatory pricing).

2.1.2 In FY2023, the JFTC opened investigations against 152 cases of suspected AMA violations and of these, completed 131 cases.

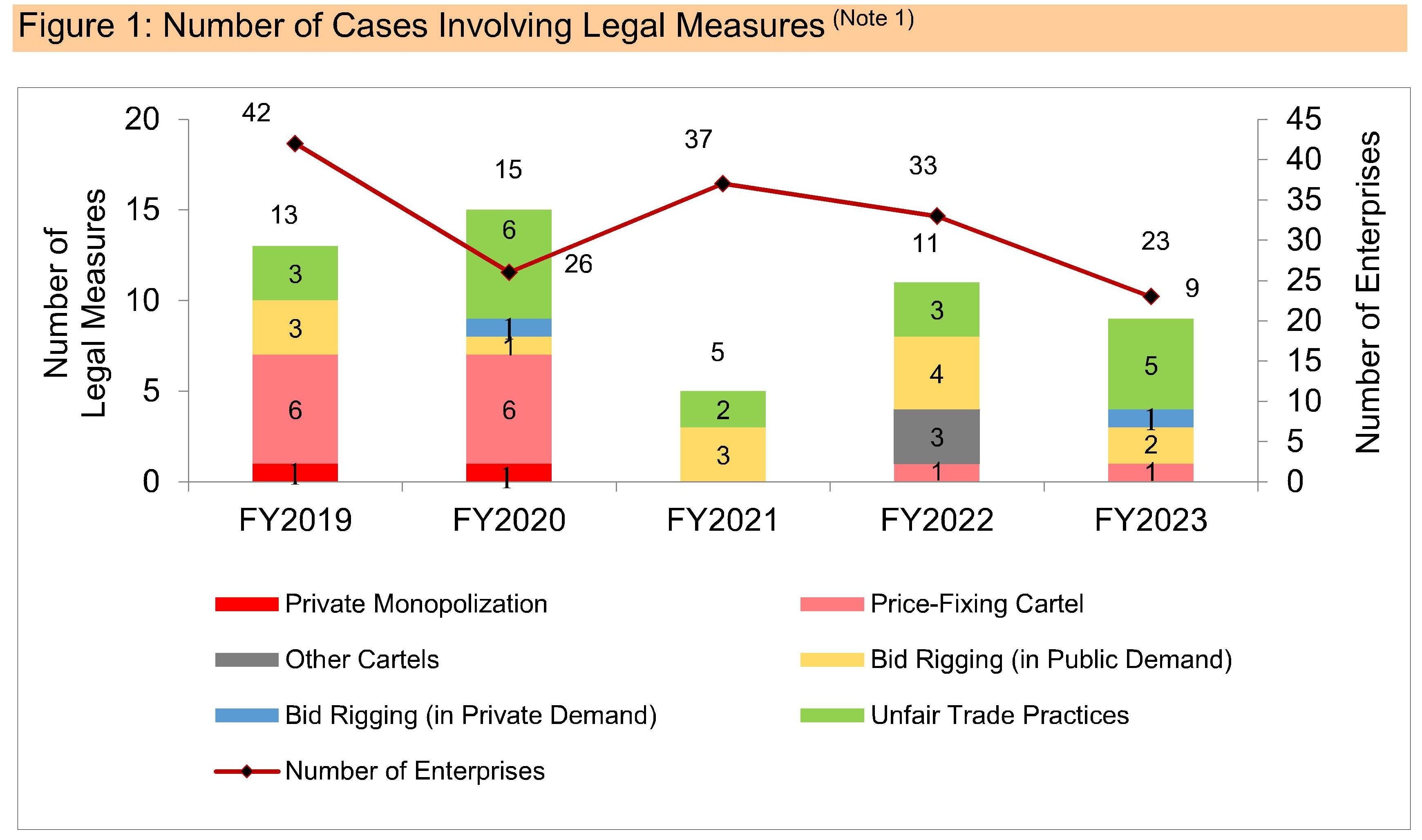

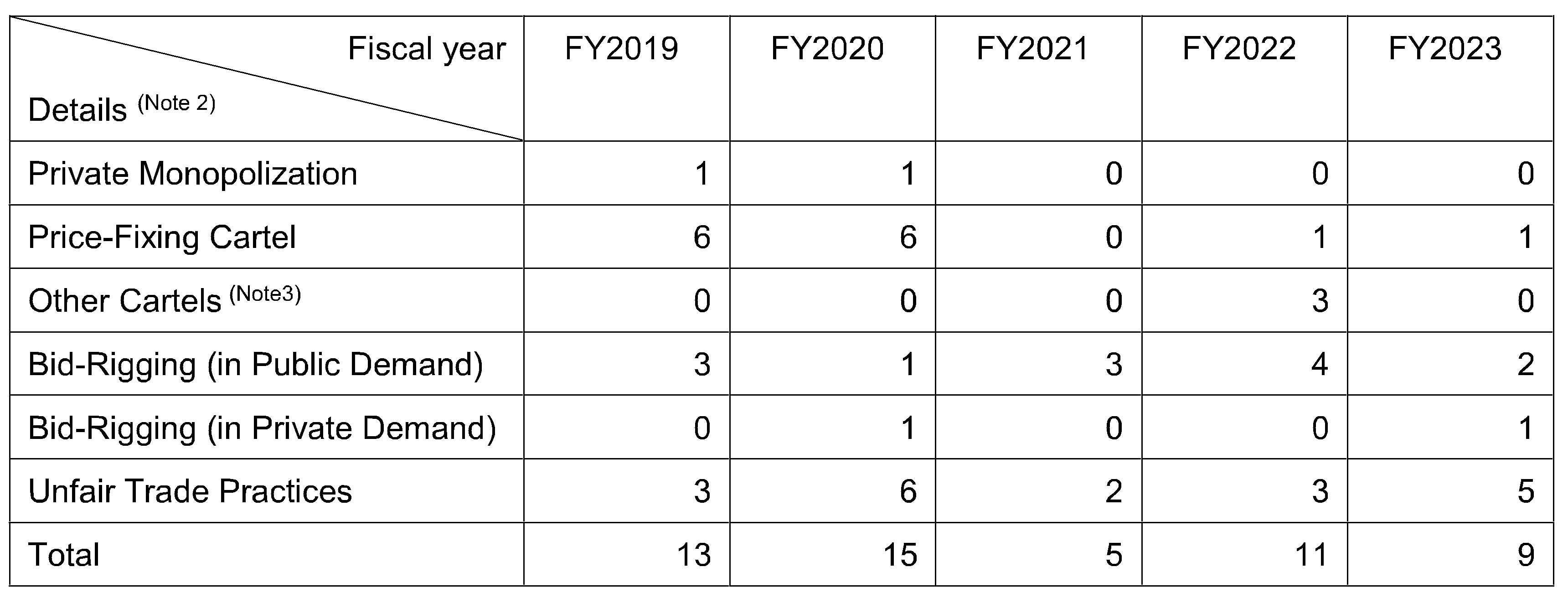

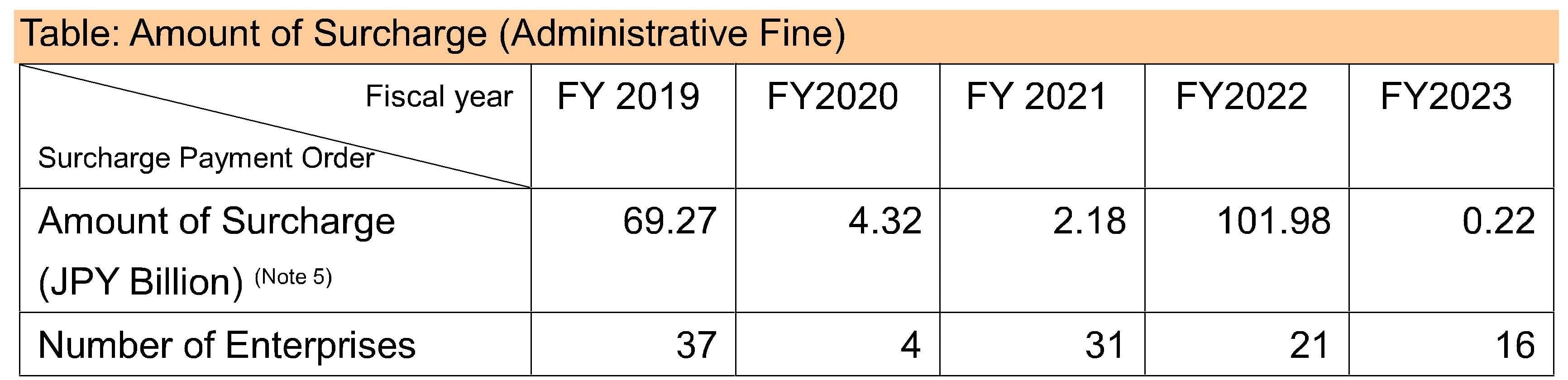

2.1.3 During the same period, the JFTC took nine legal measures, including four cease and desist orders and five commitment plan approvals. In terms of conduct types, these legal measures addressed one price-fixing cartel, two bid-rigging cases, one private demand bid-rigging case, and five unfair trade practice cases (See Figure 1). The JFTC also ordered the payment of surcharges (administrative fines) totaling JPY 223.40 million (approximately USD 1.48 million) from a total of 16 enterprises (See the table below).

Under the leniency program, the JFTC received a total of 156 applications for self-reporting their violations in FY2023.

<Cases involving cease and desist orders in FY2023> |

|

|---|---|

| Price-Fixing Cartel | • Cease and Desist Orders and Surcharge Payment Orders against Manufacturers of Wood Working Drill Bits |

| Bid-Rigging (in Public Demand) |

• Cease and Desist Orders and Surcharge Payment Orders against Participants in Biddings for Geological Investigation procured by Kochi Prefecture • Cease and Desist Orders and Surcharge Payment Orders against Participants in Biddings for the Official Gazette Paper Ordered by the National Printing Bureau |

| Bid-Rigging (in Private Demand) |

• Cease and Desist Order and Surcharge Payment Orders, etc. against Participants for City Gas Quotations, ordered by Large-Scale Users Located in the Distribution Area of Toho Gas Co., Ltd., etc. |

<Cases involving approvals of the commitment plans in FY2023> |

|

|---|---|

| Abuse of Superior Bargaining Position | • Approval of the Commitment Plan submitted by Daikoku Co., Ltd. • Approval of the Commitment Plan submitted by Tokyo interior corporation |

| Trading on Exclusive Terms or Trading on Restrictive Terms |

• Approval of the Commitment Plan submitted by the Fukuoka Ariake Sea Fisheries Cooperative Association |

| Trading on Restrictive Terms | • Approval of the Commitment Plan submitted by TOHO Cinemas Ltd. • Approval of the Commitment Plan submitted by IBJ, Inc. |

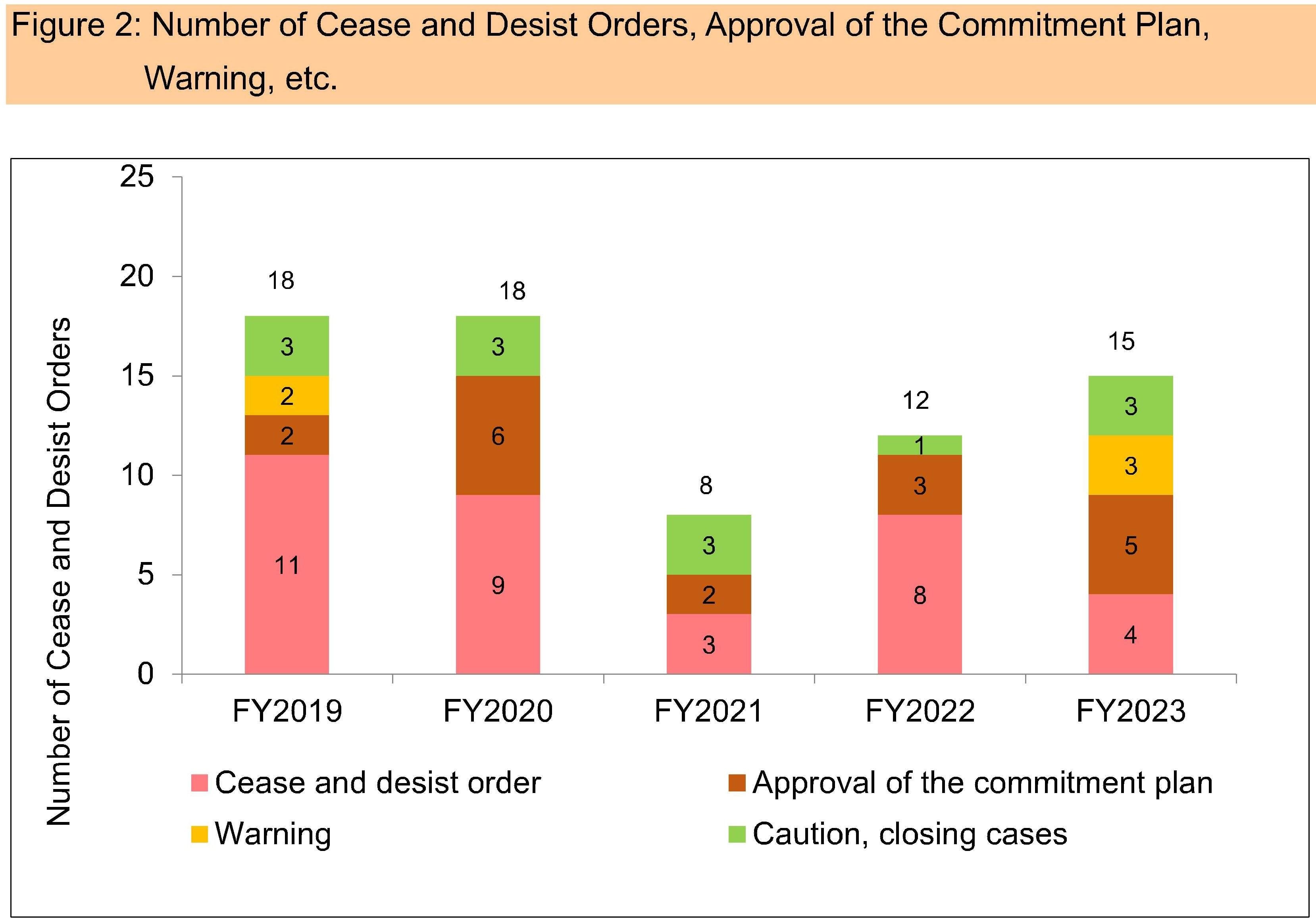

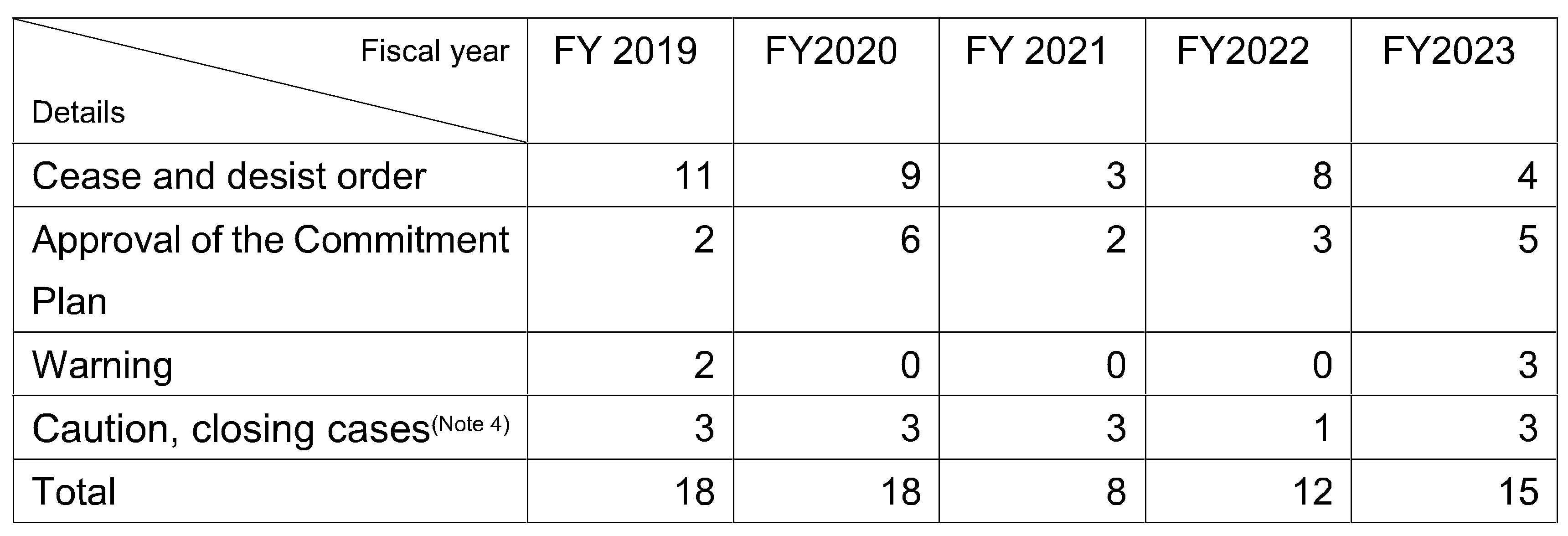

2.1.4 In FY2023, the JFTC issued three warnings and two cautions with the names of the enterprises involved being published. Additionally, one investigation was closed in light of voluntary measures taken by the suspected enterprise, which was also made public.

<Cases Involving Warnings in FY2023> • Warning to SAN-AI Retail Service Co., Ltd. • Warning to Chubu Electric Power Miraiz Co., Inc. and Toho Gas Co., Ltd. for supply of household gas and purchase of electricity after the expiration of fixed purchase price under FIT System • Warning to Chubu Electric Power Miraiz Co., Inc. and Cenergy Co. for supply of liquefied natural gas (LNG) |

<Cases Involving Cautions and Publication in FY2023> • Caution to Mizuho Securities Co., Ltd. • Caution to Logic Inc. |

<Cases Closed in Accordance with Voluntary Measures of Enterprises in FY2023> • Report from OK Corporation ceasing alleged requesting its suppliers to cover the price reduction against its competitors, in response to JFTC's ongoing enforcement efforts |

(Refer to figure 2 for numbers of the cases mentioned above)

(Note 1) “Legal Measures” consist of Cease and Desist Orders, Surcharge Payment Orders, and Approvals of Commitment Plan. If a Cease and Desist Order and a Surcharge Payment Order are jointly issued for a single case, these are inclusively counted as one legal measure.

(Note 2) If a case relating to both provisions concerning Private Monopolization and Unfair Trade Practices, such case is classified as Private Monopolization.

(Note 3) “Other cartels” are cartels involving quantity, sales channels, prohibitions on customer movement, facility restrictions, etc.

(Note 4) “Caution, closing cases” only include cases for which summaries were published.

(Note 5) Surcharges have been rounded down to the nearest ten million yen.

2.1.5 In addition, the JFTC’s efforts for appropriate and prompt law enforcement included 411 cautions (including 317 cautions for promptly dealing with unjustly low-price sales cases) on practices likely to lead to AMA violations.

2.1.6 The JFTC requests business associations and similar entities to take necessary measures in light of competition policy when, in the course of an AMA investigation, it determines that such measures should be taken.

In FY2023, the JFTC provided the related information to the Electricity and Gas Market Surveillance Commission.

2.2 Promotion of Fair Trade Practices

2.2.1 Efforts against Abuse of Superior Bargaining Position

The JFTC has conducted surveillance to prevent the abuse of superior bargaining position, which constitutes an unfair trade practice under the AMA, and has tackled such violations. In addition, a Task Force on Abuse of Superior Bargaining Position Cases has been established to conduct investigations into acts of abuse of superior bargaining position in an efficient and effective manner and to take necessary corrective measures.

In FY2023, the JFTC issued 67 cautions against suspected abuses of superior bargaining position likely to result in AMA violations.

2.2.2 Efforts against Unjust Low-Price Sales (Predatory Pricing)

The JFTC takes prompt action against unjust low-price sales in the retail industry. When unjust low-price sales by retailers are repeated, or conducted by large-scale retailers, and are considered to significantly affect other competing retailers operating in neighbouring areas, the JFTC investigates the impact of their conduct on respective competing retailers. If the JFTC finds it anticompetitive, it takes stern actions including legal measures.

In FY2023, the JFTC issued a warning in one case in the retail sector of petroleum products on the grounds of practices likely to lead to unjust low-price sales. Additionally, the JFTC issued 317 cautions in the retail sector, including liquor and petroleum products, because of the practices likely to lead to unjust low-price sales (29 cases for liquor, 233 for petroleum products, and 55 for products in other categories).

2.2.3 Proactive Elimination of Violations of the Act against Delay in Payment of Subcontract Proceeds, etc. to Subcontractors

2.2.3.1 In light of the reality of subcontracting transactions, where it is difficult to expect voluntary provision of information from subcontractors, the JFTC, in cooperation with the Small and Medium Enterprise Agency, has been making efforts to detect violations of the Subcontract Act by conducting regular surveys of main subcontracting enterprises and their subcontractors. In addition, in order to ensure that the independent business activities of small and medium-sized enterprises are not hampered by the still severe business environment surrounding them, the JFTC strives to ensure fairness in subcontracting transactions and to protect the interests of subcontractors through prompt and effective implementation of the Subcontract Act.

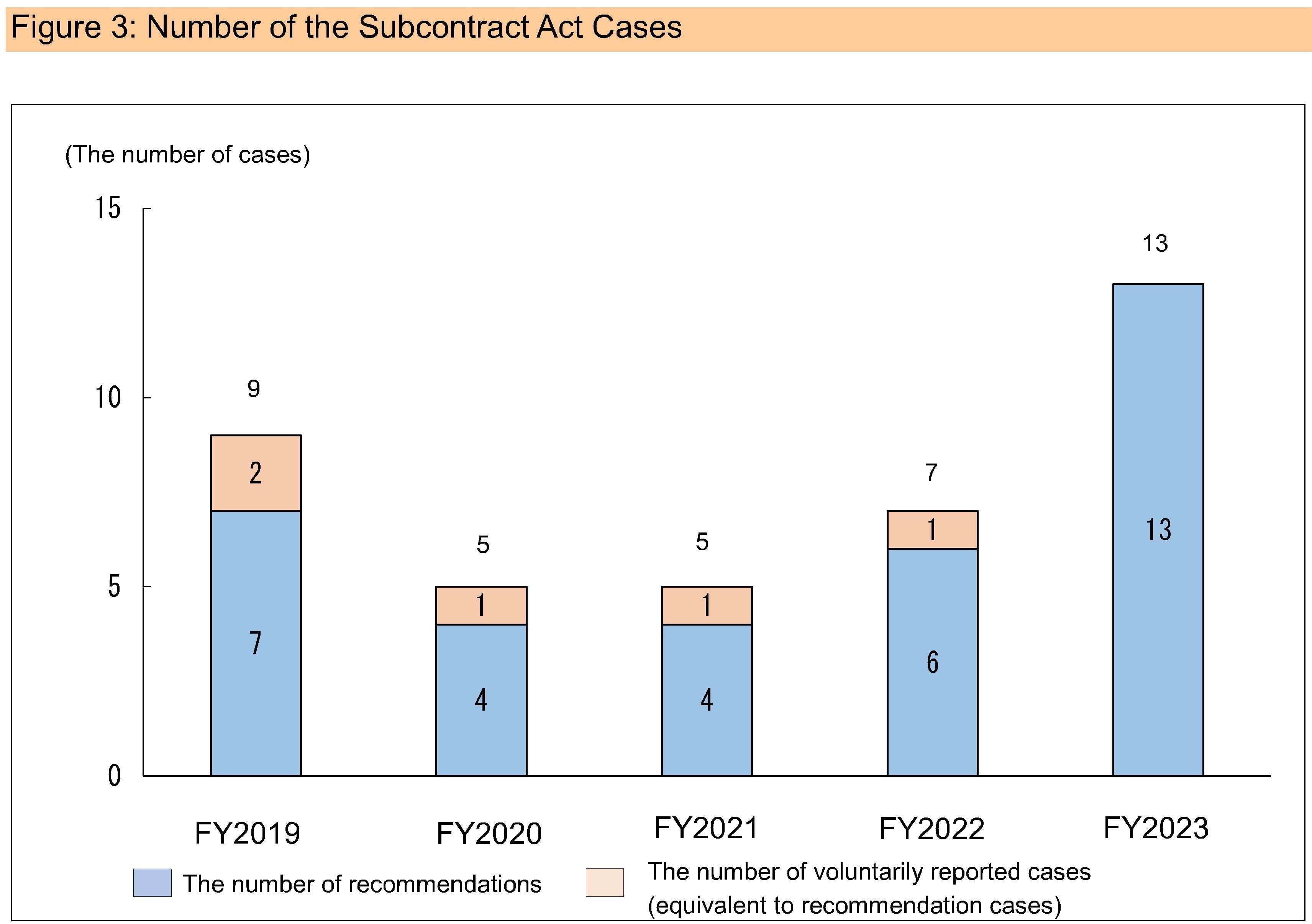

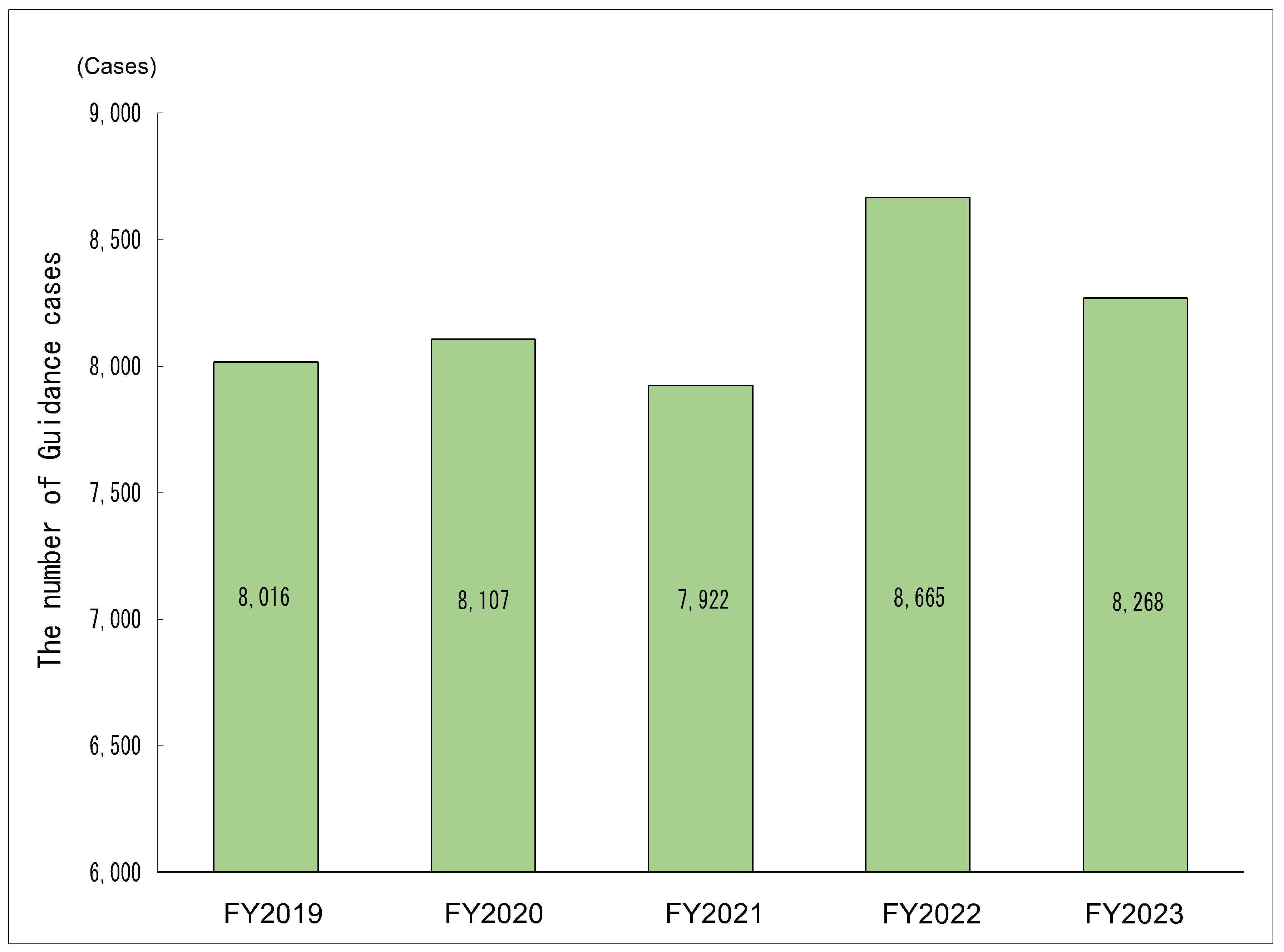

In FY2023, periodic surveys were conducted on 80,000 main subcontracting enterprises and 330,000 subcontractors doing business with them. As a result of the periodic surveys, 13 recommendations were issued and 8,268 cases of guidance were given based on the Subcontract Act (See Figure 3).

<Recommendation Cases in FY2023> • A case of reduction of subcontract proceeds in the sales of home electric appliances • A case of unjust requests for the provision of economic benefits in the sales of power semiconductors • A case of reduction of subcontract proceeds and unjust returns in the manufacturing and sales of sweets, etc. • A case of reduction of subcontract proceeds in the manufacturing and sales of automotive parts • A case of unjust changes in provision and requests for rework in the manufacturing and sales of paper pulp processed products, etc. • A case of forced purchase/use in the general motor truck transportation and freight forwarding businesses • A case of unjust requests for the provision of economic benefits in the manufacturing and sales of automotive air conditioning systems, etc. • A case of reduction of subcontract proceeds in the manufacturing and sales of automobiles, etc. • A case of reduction of subcontract proceeds and unjust returns in the sales of food, etc. • A case of unjustly setting subcontract proceeds at a level conspicuously lower than usual, forced purchase/use, and unjust requests for the provision of economic benefits in the sales of used automobiles • A case of reduction of subcontract proceeds in the retailing of women's clothes, etc. • A case involving unjust requests for the provision of economic benefits in the manufacturing and sales of industrial motors |

(Note) Refer to 2.2.3.3 below about voluntarily reported cases.

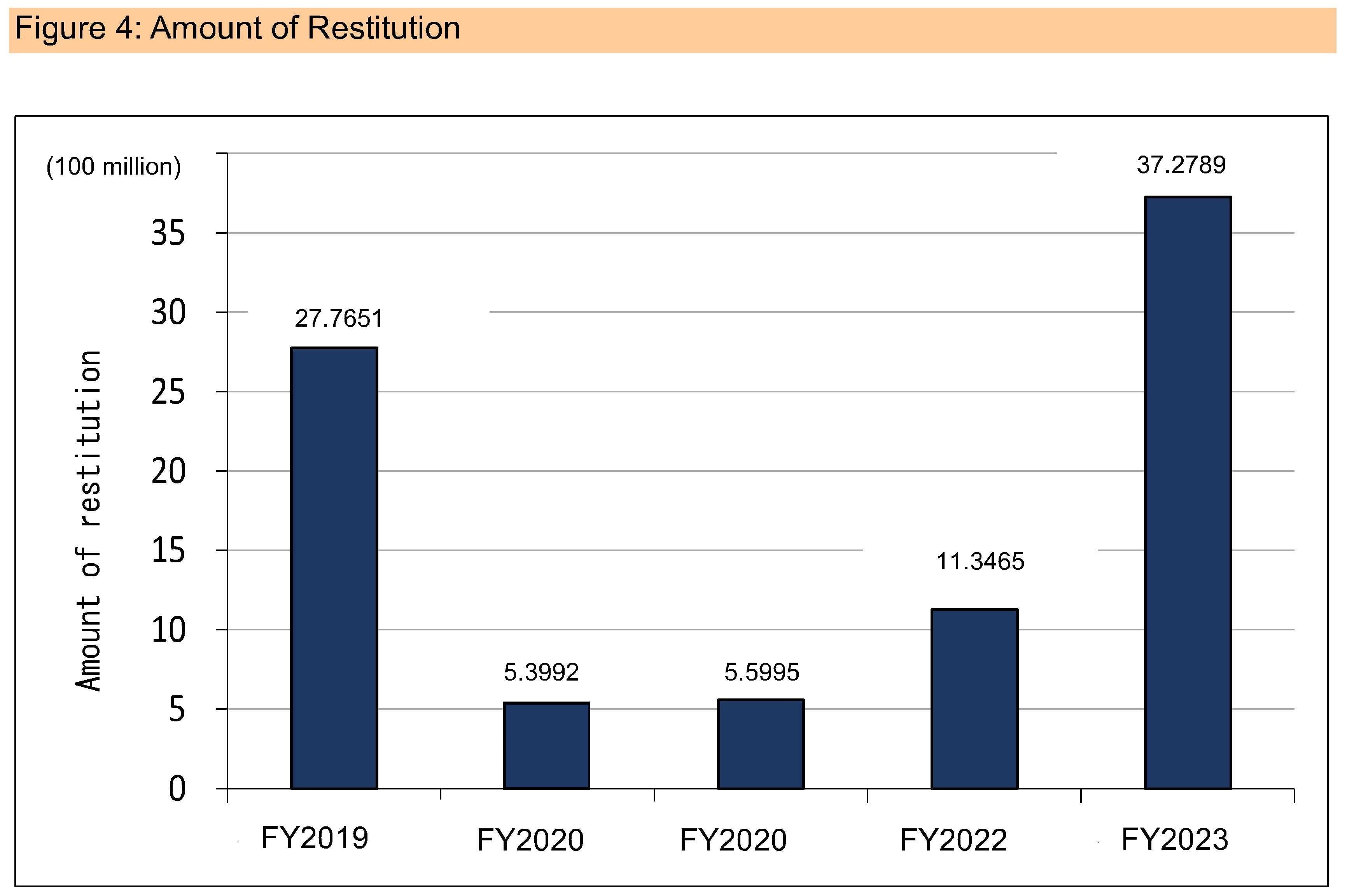

2.2.3.2 In FY2023, a total of 3,727.89 million yen worth of restitution was made to 6,122 subcontractors by 174 main subcontracting enterprises for disadvantages suffered by the subcontractors, including restitution of reduced subcontract proceeds (see Figure 4). The main items included in this amount were as follows: (1) in a case involving a reduction of subcontract proceeds, the main subcontracting enterprise returned a total of 3,322.74 million yen to the subcontractors; (2) in a case involving a delay in payment of subcontract proceeds, the main subcontracting enterprise paid a total of 247.95 million yen as interest for the delay; and (3) in a case involving return of goods, the main subcontracting enterprise withdrew goods worth 69.68 million yen in total from the subcontractors. (4) in a case involving an unjust request for the provision of economic benefits, the main subcontracting enterprise returned to the subcontractor a total of 47.70 million yen as benefits provided.

2.2.3.3 In light of the fact that voluntary improvement measures by the main subcontracting enterprises contribute to the early recovery of the disadvantages suffered by the subcontractors, the JFTC, in cases where it finds reasons such as a voluntary offer of violation and voluntary improvement measures being taken before the JFTC initiates an investigation, encourages compliance with laws and regulations by the main subcontracting enterprises. From the viewpoint of encouraging compliance by the main subcontracting enterprises, the JFTC has decided to treat such cases as not requiring a recommendation to take necessary measures to protect the interests of the subcontractor, and has made a public announcement to this effect (December 17, 2008).

In FY2023, there were 39 cases of voluntary reporting of violations by the main subcontracting enterprises. There were 39 cases of voluntary submissions processed in the same fiscal year.

2.2.4 Efforts to Achieve Appropriate Price Pass-Through

2.2.4.1 Special Study on Facilitation of Transferring Higher Costs Related to the Abuse of Superior Bargaining Position under the AMA

Based on the results of the emergency study conducted in 2022 regarding the abuse of superior bargaining position under the AMA, the JFTC carried out a “special study on facilitation of transferring higher cost” (hereinafter referred to as the "2023 Special Study") involving over 110,000 enterprises, and the results were compiled and published on December 27, 2023. During the study, the JFTC issued letters of warning to 8,175 enterprises found to leave transaction prices unchanged without consultation with numerous suppliers.

Additionally, based on the "the policy on the publication of enterprises’ names based on the results of the survey on smooth price pass-through" published on November 8, 2023, individual investigations were conducted targeting ordering parties who were frequently named by contractors in the 2023 Special Study for leaving transaction prices unchanged and significantly impacting their business activities. Starting from November of the same year, these ordering parties were informed that their enterprise names might be disclosed. Following this notification, the JFTC conducted the individual investigations which include on-site inspections and reporting orders based on Article 40 of the AMA.

As a result of the individual investigations, on March 15, 2024, the names of 10 enterprises were published under the provisions of Article 43 of the AMA. These enterprises were identified as having left transaction prices unchanged without consultation with a significant number of their contractors.

2.2.4.2 Efforts related to the Guidelines on Price Negotiation for Appropriate Pass-thorough of Labor Costs

Based on the 2023 Special Study, the JFTC compiled 12 codes of conduct outlining the actions required from both ordering parties and contractors, and published "the Guidelines on Price Negotiation for Appropriate Pass-thorough of Labor Costs" on November 29, 2023, together with the Cabinet Secretariat.

2.2.5 Efforts for Smooth Pass-On of Consumption Tax

The JFTC actively conducted on-site inspections and other investigations based on various information-gathering activities, and provided guidance in 2 cases under the Act on Special Measures for Pass-On of Consumption Tax. In addition, a total of 12.57 million yen was restored to its original state.

The Act on Special Measures for Pass-On of Consumption Tax expired on March 31, 2021. However, in accordance with Article 2, Paragraph 2 of the Supplementary Provisions of the Act, the provisions for investigations, guidance, and recommendations for violations committed prior to the expiration of the Act shall remain in effect even after the Act expires. Therefore, the JFTC will continue to promptly and appropriately deal with acts of refusal to transfer that were committed prior to the expiration of the provisions.

2.3 Improvement in Merger Review

The AMA prohibits an acquisition of shares, shareholding, merger and other transactions (hereinafter collectively referred to as "merger(s)") that would substantially restrain competition in a particular field of trade. The JFTC operates merger regulations in a prompt and appropriate way in order to ensure competitive market structure in Japan. The JFTC also actively utilizes economic analysis in merger review if necessary.

In FY2023, based on Articles 9 to 16 of the AMA, the JFTC approved 20 cases of acquiring and holding of voting rights of non-financial companies by banks or insurance companies; and it also received 121 reports from holding companies on their business and 345 prior notifications of mergers, and conducted necessary review on these cases.

Additionally, in January 2024, the JFTC announced the review results of the proposed acquisition of Asiana Airlines, Inc. by Korean Air Lines Co., Ltd. Furthermore, the JFTC announced the closing of the following two reviews: the review of the proposed acquisition of Figma, Inc. by Adobe Inc. in December 2023, and the review of the proposed acquisition of iRobot Corporation by Amazon.com, Inc. in January 2024.

3 Improvement of Competitive Environment (Advocacy)

3.1 Establishment of Guidelines, etc.

The JFTC has established and published Guidelines that identify the actions that may actually be AMA violations in activities of enterprises and trade associations, in order to prevent enterprises and trade associations from violating the AMA and to help them promote proper business activities.

<Establishment of Major Guidelines, etc. in FY2023> • Revision of the Guidelines for Promotion of Competition in the Telecommunications Business Field • Revision of the Guidelines for Proper Electric Power Trade • Request for Public Comments on the Draft of Revised Guidelines Concerning the Activities of Enterprises, etc. Toward the Realization of a Green Society Under the Antimonopoly Act |

3.2 Market Study

The JFTC has conducted market studies in a variety of fields actively and, based on their results, pointed out problems and issues from a viewpoint of the AMA and competition policy to encourage enterprises and trade associations to improve the trade practices by themselves, and recommended that regulatory authorities should review regulations and systems, thereby promoting competitive environment.

<Major Market Studies in FY2023> • Market Study Report on the Electric Vehicle (EV) Charging Service on Expressways • Market Study Report on News Content Distribution • Market Study Report on the Recycling of Used Plastic Bottles • Market Study on Electricity Market (Wholesale Sector) • Market Study Report on Connected TV and Video On-demand Service, etc. |

3.3 Study Group on Innovation and Competition Policy

Ensuring a competitive environment conducive to innovation is an important and new policy issue in competition policy, and it is important to properly assess possible future innovation as having long-term effects on the competitive environment. Based on this recognition, the JFTC has been holding the "Study Group on Innovation and Competition Policy" since March 2023 for the purpose of theoretically and systematically studying the mechanisms by which corporate behaviours affect innovation, based on economic and other knowledge in order to gain a deeper understanding and knowledge on these matters. On June 30 of the same year, the study group released an interim report that theoretically and systematically summarized the mechanisms by which various corporate actions affect innovation, based on economic and other findings.

In the interim report, it was noted that assuming the practical application of this arrangement, it is necessary to further organize and examine the fundamental perspectives and points of focus, including legal treatment, in relation to the current AMA framework, system, and operational interpretations from both legal and practical standpoints. In light of this, the study group resumed on October 27, 2023, to further organize and examine the fundamental legal framework and considerations regarding the application of the AMA to innovation issues.

3.4 Implementation of Competition Assessment

All of the government ministries and agencies have been in principle mandated to conduct an Ex-ante Regulatory Impact Assessment (“RIA”), which includes an analysis of the impacts of the regulations on competition (competition assessment), when establishing, revising or abolishing regulations. The Ex-ante RIA requires the relevant ministries and agencies to fill out the “competition assessment checklist” and then submit the completed checklist together with an Ex-ante RIA report to the Ministry of Internal Affairs and the Communications (“MIC”), which is supposed to forward the checklists to the JFTC.

In FY2023, the JFTC received 139 competition assessment checklists from the MIC and examined them. In addition, the JFTC held one meeting in which the experts with knowledge or insights about economics or policy evaluation of regulation discussed competition assessment, in order to improve an approach of competition assessment, for the purpose of appropriate implementation of RIA.

3.5 Efforts to Prevent Bid Rigging

Since procurement officers’ efforts are extremely important for the thorough elimination of bid-rigging, the JFTC has been holding training seminars on the AMA and the Act for the Prevention of Collusive Bidding at the Initiative of Government Officials for procurement officers at local governments, providing them with practical knowledge about competition law and policy. The JFTC has also been cooperating with other government ministries and agencies, local governments and publicly owned companies by dispatching its officials as resource persons or providing materials to the related seminars organized by those ministries and agencies.

In FY2023, the JFTC held 43 training seminars and dispatched resource persons to 264 training seminars hosted by government ministries and agencies, local governments and publicly owned companies.

3.6 Efforts for Enhancing AMA Compliance

Based on the results of the AMA compliance surveys conducted so far and similar efforts by competition authorities in various countries and regions, the JFTC has compiled best practices to assist individual enterprises in developing and operating effective AMA compliance programs, primarily regarding cartels and bid-rigging. The “Guide for the Design and Implementation of an Effective Antimonopoly Act Compliance Program: Focusing on Responses to Cartels and Bid-Rigging” was compiled and published on December 21, 2023.

3.7 Consultation Services

The JFTC answers questions about the AMA and related laws from enterprises, trade associations, general consumers, etc. in writing or orally.

4 Reinforcement of Foundations for Operation of Competition Policy

4.1 Development of Theoretical and Empirical Foundations for Competition Policy

Since its establishment in the JFTC in June 2003, the Competition Policy Research Center (“CPRC”) has been strengthening theoretical and empirical foundations for the enforcement of the AMA, and for planning, policy making and evaluation of the JFTC’s competition policy.

In FY2023, the CPRC held two symposiums and one “Open Seminar.”

4.2 Utilization of Economic Analysis in Competition Policy and Law Enforcement

The JFTC utilizes economic analysis in its investigation of cases involving alleged violations of the AMA, merger reviews, and various market studies. Among these cases with results published in FY2023, the ones that utilized economic analysis and had their content published are as follows:

<Merger Review> • Acquisition of nickel-cadmium batteries business of SANYO Electric Co., Ltd. by The Furukawa Battery Co., Ltd. • Acquisition of Asiana Airlines Inc. by Korean Air Co., Ltd <Various Market Studies> • Market Study Report on News Content Distribution • Market Study Report on the Recycling of Used Plastic Bottles • Market Study Report on Connected TV and Video On-demand Service, etc. <Ex-post Evaluation> • Ex-Post Evaluation Report on the Actual Trade Conditions in School Uniforms |

4.3 Response to the Globalization of the Economy

4.3.1 Reinforcement of Cooperation with Foreign Competition Authorities

Based on bilateral and multilateral competition agreements, the JFTC closely cooperates with foreign competition authorities through the ways such as notifying competition authorities of the related jurisdictions of enforcement actions. The JFTC holds bilateral meetings with competition authorities in countries or areas with particularly active economic relations with Japan.

4.3.2 Efforts Related to Economic Partnership Agreements, etc.

The JFTC recognizes that it is important that the Economic Partnership Agreements (EPAs) should be one that further promotes competition in the markets, and therefore, the JFTC is participating in efforts to conclude the EPAs. In FY2023, the JFTC participated in negotiations for the conclusion of the Indo-Pacific Economic Framework (IPEF).

4.3.3 Participation in the Multilateral Conferences

The JFTC's chair has been a member of the ICN Steering Group since its establishment. Additionally, the JFTC served as co-chair of the Unilateral Conduct Working Group from May 2020 to October 2023. In October 2023, the JFTC became an acting co-chair of the Advocacy Working Group.

In FY2023, the Advocacy Working Group, in collaboration with the World Bank, held the 2023 Competition Advocacy Contest, highlighting successful advocacy activities by competition authorities. In the category themed “Supporting the Climate Change Agenda through Competition Policy,” the JFTC’s entry, “Supporting Green Transformation (GX) through comprehensive competition initiatives,” was selected as the winner for the most outstanding initiative.

Also, The JFTC’s commissioner and other staffs participated in meetings of the Competition Committee of the Organization for Economic Cooperation and Development (OECD).

Moreover, in November 2023, the JFTC, in cooperation with the Secretariat of Headquarters for Digital Market Competition of the Cabinet Secretariat (HDMC), held the G7 Joint Competition Enforcers and Policy Makers Summit in Tokyo, attended by the heads of G7 competition authorities and policy makers. At the Summit, presided at by the JFTC Chair, the G7 competition authorities and policy makers adopted the “Digital Competition Communiqué.”

The JFTC actively participates in multilateral meetings such as the East Asia Top Level Officials’ Meeting on Competition Policy (EATOP), the Asia-Pacific Economic Cooperation (APEC), and the United Nations Conference on Trade and Development (UNCTAD).

4.3.4 Technical Assistance

The JFTC has been providing technical assistance regarding competition policy to competition authorities of the developing countries such as dispatching its officials or providing training courses.

In FY2023, the JFTC carried out technical assistance projects in Thailand and Malaysia, and in cooperation with the Japan International Cooperation Agency (JICA), and also provided training courses on competition law and policy for officials from jurisdictions where competition laws had been newly introduced or strengthened.

4.4 Raising Public Awareness of Competition Policy

The JFTC solicited opinions, requests and suggestions from members of the “Antimonopoly Policy Cooperation Committee” for the purpose of utilizing them in implementing competition policy, and of promoting better understanding of it.

In order to ensure a timely response to socioeconomic changes and advance competition policy in an effective and appropriate manner, the JFTC organizes the “Council on Antimonopoly Policy” to promote broad opinion exchanges with experts and greater public understanding of competition policy. In FY2023, three council meetings were organized.

In FY2023, the JFTC commissioners and senior officials held meetings with locally based experts in eight cities. The JFTC also arranged meetings with business and consumer groups, as well as meetings between the directors of the JFTC's regional offices and locally based experts, including members of bar associations in various districts. Additionally, to better understand the perspectives of enterprises in the field, commissioners and the Secretary General visited factories and held discussions with them.

Moreover, the JFTC hosted “Consumer Seminars” to introduce an overview of the AMA and the JFTC’s activities to general consumers in cities without its headquarter or regional offices, in order to increase people’s awareness of the AMA and the related laws.

The JFTC’s efforts also included activities for raising awareness of competition policy through school education. The JFTC dispatches its officials to junior high schools, high schools and universities (including graduate schools) and they introduce the roles of competition in economic activities to the students. The effort is called “Antimonopoly Act Class” or “Delivery Lecture.”

<Main Initiatives in FY2023>(Note) • Hearing opinions from Members of Antimonopoly Policy Cooperation Committee (148 cases) • Organizing Antimonopoly Policy Council meetings (3 times) • Holding meetings to exchange opinions with business organizations (6 times) • Holding meetings to exchange opinions with consumer groups (10 groups) • Holding meetings with locally based experts (Hokkaido Kushiro, Fukushima, Chiba, Shizuoka, Kobe, Yamaguchi Shimonoseki, Matsuyama and Saga cities) • Holding meetings with other locally based experts (94 times) • Holding meetings with bar associations (17 times) • Factory visits and round table discussions at the factories and other facilities of enterprises (16 times) • Hosting Consumer Seminars (88 times) • Holding Antimonopoly Act Classes (54 times for junior high school students, 36 times for high school students, 143 times for university students, etc.) |

(Note) In addition to in-person meetings, the meetings were held using web conferencing formats.